The release of the Fintech Marketing Outlook by Africa Fintech Summit spurred conversations within the Fintech space on the necessity of customer retention strategies in uncertain times such as this.

According to the report,

“In the midst of persistent foreign exchange fluctuations, Nigerian fintech startups are poised to encounter a mounting challenge in the form of escalating customer acquisition costs. This imminent scenario necessitates a strategic recalibration of budgets and a proactive exploration of innovative, cost effective acquisition channels to ensure sustained growth”.

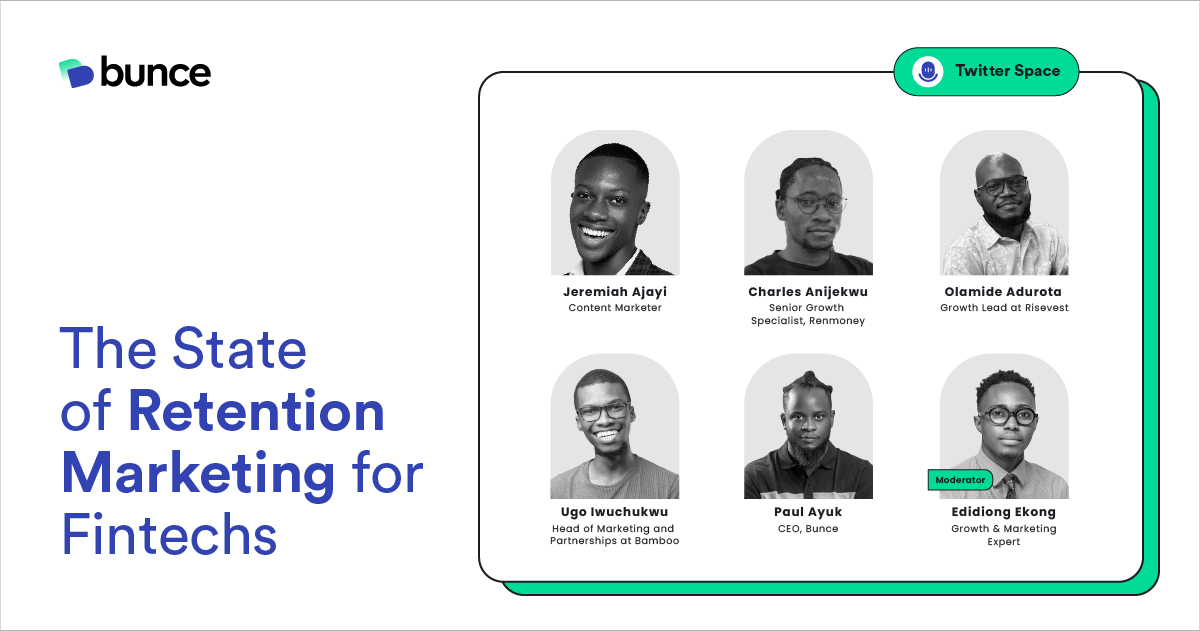

It prompted us at Bunce to engage the reporters Jeremiah Ajayi and Charles Anijekwu on their discoveries and predictions as stated in the report, in an X (Twitter) space conversation. We also invited seasoned Nigerian fintech marketing professionals, Olamide Adurota, Growth lead at Risevest, Ugo Iwuchukwu, Head of Marketing and Partnerships at Bamboo, Edidiong Ekong, Growth and Marketing expert and Paul Ayuk, CEO of Bunce to discuss the state of retention marketing for fintechs and possible ways for sustainable growth.

At Bunce, we’ve always been advocates for helping businesses increase retention and customer lifetime value through effectively engaging their audience using the right channels, so it came naturally to us to host the conversation.

In this conversation, our guests talk about:

- The cause of the dip in VC-backed funding within the fintech space

- Why customer acquisition costs keep getting high

- How fintech markets can use data for effective retention strategies.

- Utilizing AI, rewards, and loyalty programs for retention

- Personalization and multichannel customer engagement

- How user-centric onboarding and clear messaging can improve retention

Read some highlights below.

Edidiong Ekong (Moderator):

What do you think has caused the dip in VC-backed funding and to what extent has it affected the growth of the sector?

Jeremiah Ajayi:

Thanks for that question, the dip in the VC funding which has continued year on year and is still projected to continue till 2024 based on BCG’s report and even reports from thought leaders like Ola Brown is a ripple effect of what is going on globally. You know we are still in a very nascent stage in our VC industry so most of the funds that run our VC firms are backed by global investors and beyond that, the high net worth individuals (HNIs) backing our funds, most of them have their assets in foreign currencies like dollars. And what this means is that global macroeconomic factors tend to affect our operations.

So globally there was a VC industry downturn. And it’s not just native to Nigeria or Africa, it happened globally. And why we survived this burst is because of the boom of 2020/2021. We didn’t really experience the drop in 2022 but in 2023 we really came crashing. And the fintech sector is the leading sector for investment in Nigeria, and Africa. In Africa, Nigeria has lost it’s ranking as the most funded fintech sector, I think it’s now the East that has it. I’m not so sure.

So my point is, being the biggest sector obviously, when the entire sector experiences a downturn, the biggest sector tends to feel it the most. And we can link this global economic downturn to things like higher interest rate due to inflation which even went up higher in the U.S and even macroeconomic downturns everywhere, the Russia, Ukraine war. So there’s a lot of factors that led to this global economic downturns which also affected high netwoth individuals (HNIs), development finance institutions, limited partners, all of whom contribute the money which these firms run.

Let’s not also forget that the development of startups also influence the performance. And so far, year on year the performance has not been that impressive and so there’s been more stringent rounds. Unlike before when a round could close in 3 months, now it’s closing in say 6 months and this has led to overral decrease in funding rounds and that explains why we’ve seen this drop. And it is still projected to continue further because of the overlined macro-economic factors at play.

Edidiong Ekong:

It’s popular information that customer acquisition cost is high, And I guess we all know that having to retain customers possibly also is even a lot better, right. I think for me the question is why are we having this high cost, especially around the fintech vertical?

Ugo Iwuchukwu:

There are a couple of reasons why customer acquisition costs are high, depending on how you want to look at it. And this is sort of closely related to what was said just previously, you had a situation where there was a lot of capital that had followed the market and you had a bunch of startups trying to acquire the same share of wallet from the same customers.

If you’re talking around paid digital spend, almost everyone is targeting the same set of people, if that makes sense, right. If you’re in fintech retail, it doesn’t matter whether you’re a bank, whether you’re invest-tech like us, whatever you’re doing, its the same set of customers.

I would even go so far as to argue that if you were in B2B fintech, it’s pretty much also the same set of customers. But you approach it differently. So that demand and supply basically increases the cost that you would spend per channel because you have more people playing, you know, trying to outbid each other as the situation was. So that’s one thing, that’s sort of driven demand.

A second thing is the fact that you’re seeing what was relatively speaking, the middle class of Nigeria gets hollowed out, will contribute in some ways to that because that same set of customers is gradually reducing, if you get what I mean.

And if you’re trying to acquire them in their new location, right, you’ve gone from, you know, playing with Nigerians’ fees, quote and unquote to playing in like more developed markets that have like higher fees and return on investments. I think that as well has sort of contributed to it. So poverty is a short way of saying what I’ve said.

Edidiong Ekong:

How do you think that most of the fintech brands today can use this data to remove guess work, identify churn patterns, and possibly also implement like, a very effective strategist towards retention?

Paul Ayuk:

I think the first thing for any business would be to determine what churn is, because, I mean, there’s so many. If you look at fintech, there’s loan, digital loans, there’s investments, wealth, tech, insure tech and everything. And everyone has different criteria for what is considered churn for a customer. So once that criteria is clear, the very first thing businesses need to do is to aggregate their data.

So typically businesses have data in silos, maybe data in a payment provider, in an accounting provider, or an Excel sheet or any system. Once you’re able to get that data together, you can then perform analysis. And that analysis is basically segmentation. So you just sort of create different segments of the data you have, and once you analyze that data, you can then see the patterns.

Like, the patterns will become clear who the churned users are based off your criteria, and then the next thing to do is start communicating with them.

First of all, one thing you gain with data analysis is that you tend to see customers that are about to churn based on the pattern of customers that have already churned.

And so once you’re armed with this knowledge and these different segments, you could then come up with the strategy or the messaging to reengage these customers. And that’s when you could leverage different channels based off the active channels of the customers and then sort of push out the communication to them. And, you know, if need be, even do a lot of manual follow ups and stuff like that.

But the first things is really having the criteria of what churn means for your business. Getting data together from different silos, getting it together in one platform, performing analysis on the data and segmentation, and personalizing the communication you send out.

Once the communications start going out, there’s definitely feedback coming in, and from that, you’re able to understand directions to go.

If you enjoyed this excerpt, listen to the full session here.