‘Profit is the lifeblood of any business’. Those were the words a friend said to me recently. Although it wasn’t my first time hearing those words, it struck a chord this time considering my current line of work. It became even more profound when I came across the Forrester report which stated, 59% of decision-makers at Subscription-based businesses cited ‘identifying leakage’ as their top challenge.

This problem isn’t peculiar to subscription businesses. Most businesses can’t tell why customers are dropping off and at what point they quit. Therefore, it is imperative to discover why and where customers drop off as it affects the longevity of a business.

In other words, businesses should invest in revenue management to gain better customer engagement and grow long-term.

In this piece, I’ll show how digital businesses can leverage revenue management strategies to increase revenue and gain customer loyalty.

What is Revenue Management?

Revenue management is a strategy that allows businesses to maximize data for better customer engagement and to build a sustainable business structure. It’s been defined many times as selling the right product to the right customer at the right time and the right price.

Take Udemy, an online education platform, for example, they’ve unlocked a way to make more sales and acquire loyal customers. Udemy runs a discount strategy whereby they offer courses for lower than the actual prices. The discount rate fluctuates during different sales periods. What this strategy does is that it builds anticipation and the fear of missing out in customers (FOMO). I bet it took understanding of the market and their customers to adopt this strategy.

To come up with revenue optimization strategies, a business must be able to use the data available to them, like how customers buy and what they buy to retarget these customers with enticing offerings. You must know the right time for sales and the right pricing for your customers. Essentially, it requires a blend of empathy and business intelligence.

Why is Revenue Management Important for Digital Businesses?

Revenue management is important for businesses who want to play the long game without sacrificing customer satisfaction or lowering business standards. For digital businesses, here are some reasons why revenue management is important.

1. Cash Flow

Revenue management helps you to keep track of how much comes into a business, how frequent sales occur, and how much goes out of a business. With a keen eye on cash flow data, you can discover new ways to increase inflow of cash.

2. Understanding Product Value and Business Growth

One major way to gauge product value is through customer feedback. Now, it could be through direct feedback on social media platforms and customer surveys or indirect feedback by studying customer behaviour. One thing is certain, customers are always talking and revenue management is a good way to listen.

A high cart abandonment rate for instance may indicate that customers are comparing prices between your product and competition or that they are experiencing difficulties with the checkout process. This feedback is helpful for a product review.

Jack Welch, an American business executive and former chairman of General Electric, had it right when he said,

Without doubt, there are lots of ways to measure the pulse of a business. But if you have employee engagement, customer satisfaction, and cash flow right, you can be sure your company is healthy and on the way to winning.

Revenue management seeks the balance between a great product, satisfied customers, and healthy cash flow.

3. Predict the Market

Staying informed can help you to play a different strategy game. You can increase and reduce prices based on different conditions and you can forecast revenue based on past events. The Udemy discount strategy exemplified above is a good way to forecast revenue based on past sales and shoot for higher sales next sales period. It also helps you to keep an eye on the industry.

4. Set the Right Price

Pricing in revenue management matters. Comparing your price with competitor’s price can inform and influence your pricing strategy. Can you sell a little lower? Or can you communicate why customers should buy your product at a higher price?

Revenue management gives a holistic view of both customer and revenue data which influences pricing strategies.

Revenue Metrics Digital Businesses Can Track

There are relevant metrics businesses can track across different departments in a company. When it comes to revenue management, here are some metrics to look out for.

1. Customer Lifetime Value

Customer lifetime value (CLV) is a key metric to calculate for all kinds of digital businesses, whether subscription or e-commerce. Calculating CLV can reveal your loyal customers, your highest paying, average paying and low paying customers. It is calculated as the amount of money or sales from a customer over a period of time, either quarterly or in a year.

Take for instance,

- Customer A purchases your services monthly at $500, and stays for two years

- Customer B purchases at $500 and stays for six months

- Customer C purchases at $300 and stays for two years

The CLV for customer A is valued at $12000, CLV for customer B is valued at $3000 and CLV for customer C is $7,200.

The highest paying customer over a period of time can be deceptive when it comes to discovering your most loyal customers. From the scenario above, it is obvious that Customer C is more dedicated to the product than Customer B although his monthly purchase is lower. His period of stay is longer.

The longer the customer stays with your business, the higher their customer lifetime value.

On the bright side, understanding this metric helps you discover other metrics like customer retention, and churn rate, and helps you come up with a better strategy for customer engagement.

2. Churn Rate

Churn rate is the number of customers who leave or stop buying from your business on a monthly, quarterly or annual basis. A high churn rate is bad for business as it impacts on your business revenue negatively. It could mean different things, either your product is of low value to your customers, poor customer experience, or there isn’t enough marketing.

Knowing your churn rate helps you track the health of your business. It is also a good point to compare your product to what’s obtainable in your industry to know where the glitch is from.

3. Growth Rate

As the name implies, it shows growth progression, for example from the previous monthly earning to the current. Growth rate is calculated as

Current earnings – Previous earnings. Divide the difference by the previous earning and multiply by 100.

CE – PE

PE x 100 = Growth rate.

Calculating growth rate gives you insight into where the spike came from, a cross-sell, a plan upgrade for subscription businesses, or a new customer? This is important to keep track of as it indicates business progress.

4. Conversion Rate

Conversion rate helps you feel the impulse of your marketing strategy. You can track how many leads or prospects turned to paying customers. For subscription businesses, you can track,

- How many free trial users converted to paying customers

- How many upgraded to a higher plan

5. MRR

This revenue metric is for SaaS businesses. It calculates the monthly recurring revenue. Simply put, how much comes in consistently, monthly, from customers subscribed to your product. Calculating MRR helps you discover cancelled subscriptions which impact your monthly recurring revenue and ultimately your annual recurring revenue.

6. ARR

Like MRR, ARR is a subscription-based metric that calculates the business’ annual recurring revenue. This helps you monitor your revenue growth year over year and strategize for the year ahead.

These revenue metrics are discovery channels to know what’s working and what’s not. From these insights, you can employ a better marketing/sales strategy and improve on what’s working for better customer acquisition and retention. Ultimately, this impacts revenue greatly.

How Bunce Helps Digital Businesses Manage Revenue

Revenue management is beneficial although it involves a lot of data. Manually going over these data or juggling different tools to analyze data can be daunting and time-consuming. According to this Forrester research, 55% of decision-makers at subscription-based businesses cited reconciling data across disparate tools as a major challenge.

With revenue management platforms, particularly tailored for your business type, the process is seamless and error-free. Here are some ways Bunce helps digital businesses manage revenue.

1. Single Source of Truth for Your Business Data

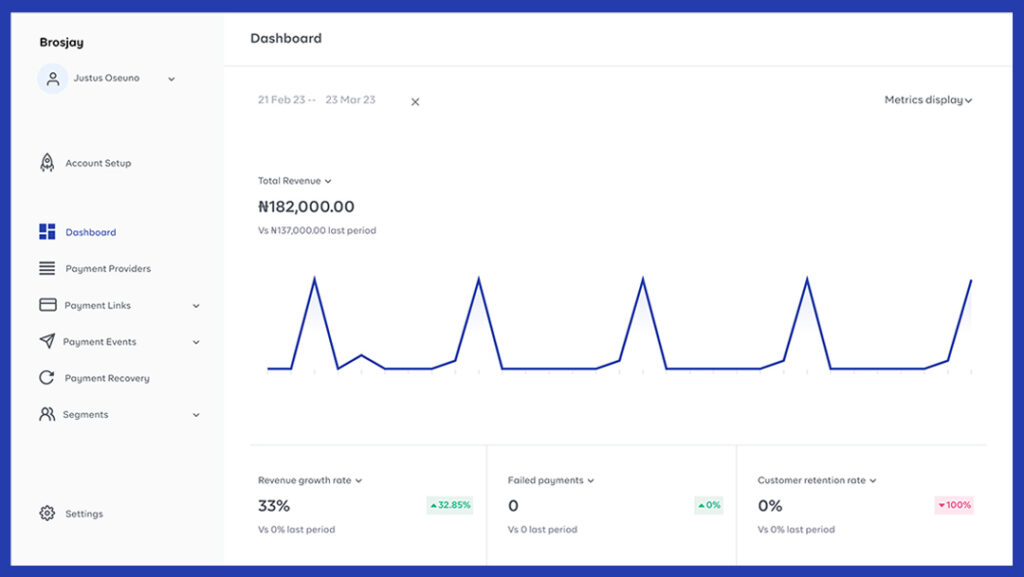

Bunce serves as a single source of truth for all teams. Rather than collect data across different tools, you can view and analyze payment data received from all your integrated payment providers, all at once, and share results with stakeholders. Team members can also view and stay updated on business data, cutting out the need to explain themselves many times. Here’s what it looks like.

2. Failed Payment Recovery

As a payment automation tool, Bunce’s process ensures failed online payments are prevented and recovered, if and when they occur. Bunce does this in different ways,

Smart Retries

On some occasions, online payment failures still occur even after orchestrating payments. It is at this point a failed payment recovery is initiated to ensure that revenue isn’t lost. As the name implies, Bunce’s smart retries is an automated process that helps the system retry collecting payments from the customer’s account after the initial failed attempt.

Customer Messaging

This works both in preventing and recovering failed online payments. Take for instance, in a subscription business, a customer’s credit/debit card is about to expire or has expired. Most businesses and customers may not be aware of the situation until the point of renewing subscription payments. Bunce helps your business detect this and send reminders to such customers to renew their cards or update recent card details to enable them renew their subscriptions. Messages like this prevent failed online payments than waiting for the payments to fail. In the case of recovery, another personalized message is sent out to customers to explain the reason for the failed payments.

Multichannel Messaging

Still part of customer messaging, Bunce sends out messages to customers via different channels, SMS, emails, website, and in-app notification. This ensures your business is never out of touch and communicates with customers through their preferred channel. Communication through multi-channels means more open rates.

With payment automation and a smooth recovery process, Bunce ensures revenue is optimized for businesses.

3. Customer Segmentation

It is easy to segment customers once you can view and analyze all customer data in a single dashboard. Bunce helps you do this easily by providing a single source of truth for your business data. As a digital business, you can segment customers based on,

- Demographics like age & location.

- Subscription plan, for subscription-based businesses.

- High-paying & low-paying customers

- New customers – Bunce’s Cohort analysis is worthy of mention here. It is a feature that helps businesses segment customers based on batches, say 10 people came in the month of January, and keeps track of them to know how many in a particular batch were retained and how many churned.

- Preferred payment method – Here, you can segment customers based on how they make payments, through credit/debit cards, mobile money, bank transfers, etc.

Segmentation rules can be set based on what the business hopes to track. A major reason for customer segmentation is to target customers in each group with personalized emails and ads.

Revenue management platforms help businesses to make sense of data in a single dashboard and take action, and all actions taken are geared towards sustainable business growth. Bunce as a payment automation and revenue management platform helps businesses manage & grow revenue, retain customers and gain customer loyalty.

Bunce: The Payment Automation and Revenue Management Platform for Your Business

As a digital business, there are many demands to meet customer satisfaction. Even with a great product, you must market, and groom leads till they become paying customers. Then ensure they remain paying customers.

Revenue management is the ticket to fighting churn and guaranteeing repeat customers. It is also the bridge between one-time sales, recurring sales, customer satisfaction, customer loyalty and revenue growth, which is a strong indicator of a growing business.

Make Bunce the go-to payment automation and revenue management platform for your business. Watch a demo and signup here.