Nigeria’s banking sector is facing a quiet crisis: as of December 2024, over 19.69 million bank accounts were dormant, according to NIBSS.

Banks are losing millions in revenue due to inactive accounts, dropped transactions, and short-lived customer relationships.

But it’s not inevitable. With Bunce, banks can reverse this trend, by proactively engaging users, predicting churn, and reactivating accounts at scale.

Why Customers Go Dormant and How Bunce Solves It

- Most banks still rely on manual, disconnected CRMs with no behavioral logic.

- Communication is generic, often arriving too late to make an impact.

- There’s no visibility into early transaction attrition or user behavior.

- Risk signals are missed, and at-risk customers quietly churn.

Bunce addresses these exact gaps with a our data-driven engagement platfrom that connects to your systems, analyzes behavior in real-time, and drives personalized reactivation journeys automatically.

How Bunce Works

Bunce offers a fully integrated, no-code platform that moves customers from signup to sustained usage. It’s not just a tool, it’s a customer engagement engine that is:

Connects to Your Data in Real Time

Bunce integrates seamlessly with your core banking systems, CRMs, apps, or data sources — pulling in real-time behavioral data like:

- Customer sign-ups

- Transaction frequency

- Inactive accounts

- Abandoned onboarding flows

- Card usage, loan requests, savings actions

This helps the bank see what users are doing or not doing at any moment.

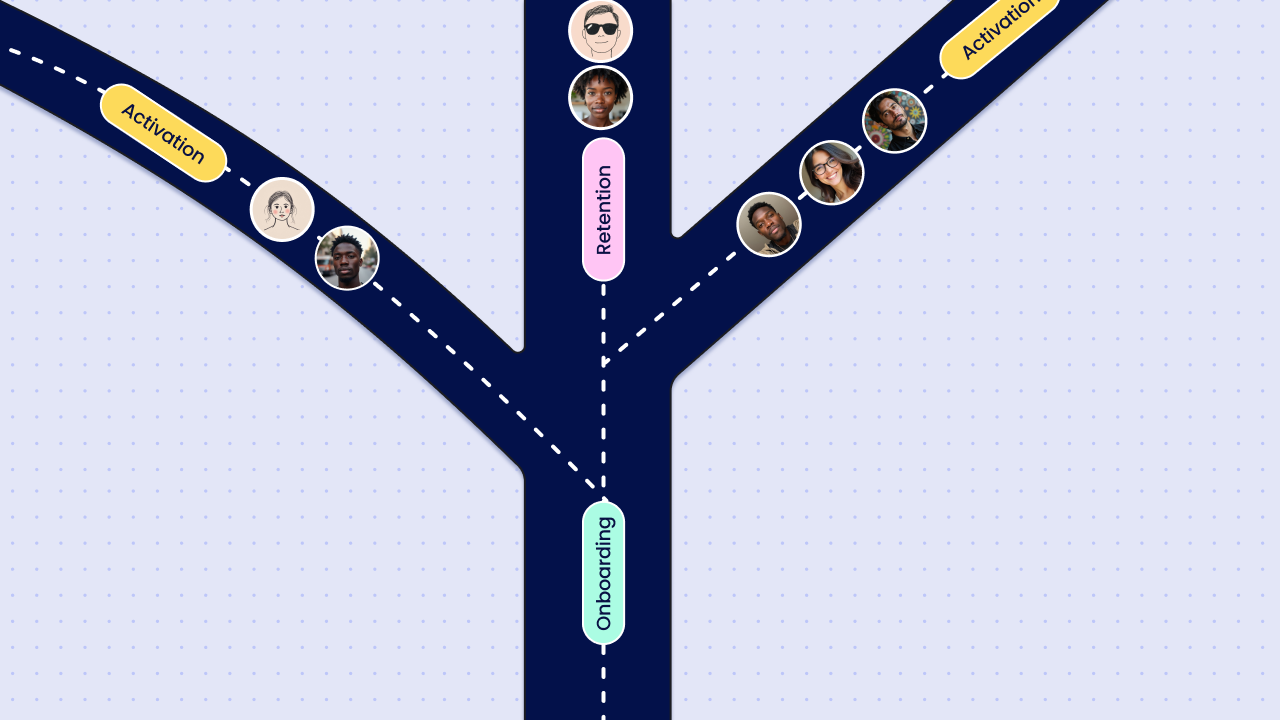

Creates Automated, Behavior-Based Journeys

With this data, Bunce lets banks build automated engagement workflows tailored to user actions or inactivity. For example:

- If a customer signs up but doesn’t activate their debit card within 3 days, send a WhatsApp nudge with a how-to guide.

- If a customer stops using their account for 30 days, trigger a reactivation SMS campaign.

- If a customer uses their account frequently, reward loyalty with personalized offers.

These journeys run 24/7, ensuring no opportunity to engage is missed.

Engages Customers Across Multiple Channels

Bunce supports multi-channel communication, including:

- WhatsApp

- SMS

- Email

- Push Notifications

Banks can set smart rules for when, where, and how messages are sent ensuring the right message hits at the right time on the right channel.

Tracks Performance and Measures ROI

Bunce provides banks with a live dashboard showing:

- Activation rates

- Conversion goals

- Channel performance

- Revenue impact from each campaign

You can set conversion goals (e.g., card activation, login, KYC completion) and measure exactly which engagement drove it.

How Bunce re-engages Inactive and Dormant Accounts (Demo)

Key Results Nigerian Banks Achieve with Bunce

- Faster time to value for new users

- Reduced dormant accounts and transaction attrition

- Higher activation and retention rates

- Improved CLTV and ROI on acquisition spend

- Fewer manual interventions, less reliance on tech teams

Banks using Bunce have cut activation drop-offs significantly and are now scaling acquisition with confidence.

Dormant accounts aren’t just inactive — they’re untapped opportunities.

Bunce helps banks move beyond one-time signups with intelligent workflows that re-engage drop-offs, recover lost revenue, and turn passive users into loyal customers.

Book a demo today and see how Bunce activates the full potential of every customer you acquire.