Defending your marketing budget is dreadful but not new to marketers. And so you need to judiciously channel your resources to things that bring the most ROI. One effective way to do this is to adopt a data-driven marketing approach. This approach has proven effective as businesses who use data-driven personalization have 5 to 8 times ROI on their marketing spend.

According to the Fintech Marketing Outlook report,

Analyzing customer data will become more paramount for fintech companies, enabling them to discern churn patterns and optimize retention strategies. Through segmentation and personalized interventions, startups will proactively mitigate attrition, maximizing customer lifetime value and sustainability.

A data-driven marketing approach helps you create better marketing campaigns, understand and target customers effectively using the right channels, and increase customer retention which is the desire of every business.

In this article, you’ll get an understanding of data-driven marketing, the challenges and how to implement it.

What is Data-driven Marketing?

Data-driven marketing is a marketing approach that uses customer data to predict customer needs by understanding their behaviors, patterns, and preferences. It collects geographical data, demographics, transaction data, website visits, and social media interactions.

Benefits of Data-driven Marketing

Organizations collect different data types to help them target customers more effectively. Fintechs normally go through the KYC process for regulation compliance and internal uses to help them understand and segment customers for better targeting. Here are the core benefits of data-driven marketing.

1. Enhanced Personalization and Customer Experiences

When you collect and analyze customer data, you can predict what customers need, segment them according to their behaviors and deliver a more human and personalized customer experience. You also improve their overall experience with your product and increase their lifetime value. This is certain because 80% of consumers will purchase from brands offering personalized experiences, and 40% are more likely to spend more than planned when experiences are highly personalized.

2. Better Decision Making

Understanding your customer data helps you make better marketing decisions. For example, you can recommend a marketing campaign to execute for each customer segment and also review the success of these campaigns to know what works and what doesn’t. This also helps you allocate your marketing budget effectively.

Some marketing campaigns to consider are win-back campaigns to win back dormant or inactive customers, and an upselling campaign to sell a new feature or product to customers.

3. Better Customer Engagement

As the customer journey evolves, there’s a need for different kinds of communication through various channels. Analyzing your customer data helps you know what messages resonate with your customers per time, and through the appropriate channels. This increases conversion rate and customer loyalty.

4. Increased Conversion and Customer Loyalty

When you target the right messages and marketing campaigns to the right customers, there’s a high chance of converting them to make the desired action, be it buying or investing more. As a result of your proactive customer engagement and personalized marketing outreach, you win loyal customers who not only stay with your business but evangelize it.

Common Challenges with Data-driven Marketing

As important as a data-driven marketing approach is, 87% of marketers said data is their most underutilized asset. This isn’t because there is a lack of awareness of the importance of data, but some factors make data-driven marketing challenging.

1. Lack of Analytical Skills

Not all marketers can comprehend and analyze data. This calls for training of in-house marketers to learn how to analyze data and make informed marketing decisions, or hire a data analyst to make sense of the data available. After all, if you don’t understand your customers, you won’t know how to care for them in the best way, neither will you know how to turn them into advocates.

2. Fragmented Data Across Platforms

When you figure out the most important data to track for your business, one of the things to avoid is data fragmentation. This is when you have your customer data across various platforms. This makes data tracking, analysis, and reporting cumbersome. For example, your email, WhatsApp, In-app notification flows and transaction data can be managed using a customer engagement tool like Bunce. You can also use a social media engagement tool to manage data from your social interactions.

3. Data security and privacy

In the fintech industry, data security is a big deal. Fintechs and any organization that handles customer data must ensure the privacy of their data. This is why every country has regulations guiding corporate entities.

How to Implement Data-Driven Marketing

Data-driven marketing is about understanding the customer better and using the right tools and strategies to predict and meet their needs. Here are a few steps on how to begin implementing data-driven marketing.

1. Set Clear Goals

There’s a level of curiosity and dissatisfaction that would make any marketer want to take a data-driven approach. To keep track of your progress, you should set clear goals and make this known to teammates and executives. Your goal could be to build brand awareness, increase customer engagement, and make more sales. Set these goals and know the right KPIs to track. Some relevant product KPIs to track are customer activation rate, feature adoption, transaction volume, onboarding completion, etc.

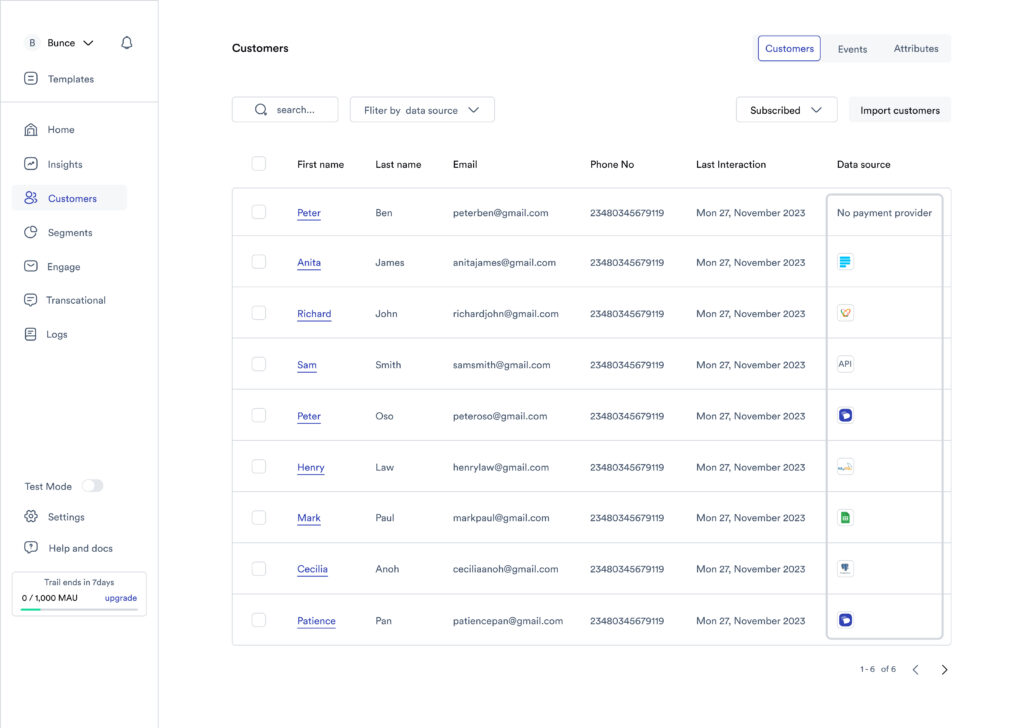

2. Organise Data in a Central Platform

After deciding on the data type to track, assemble all relevant data from different sources into a central platform for easy access and analysis. Customer data platforms like Bunce help you bring together data from data sources like payment providers, excel data warehouses, and accounting software and you can track data in real-time. This helps you maintain a single source of record of your customers for better segmentation and personalized experience.

[Bunce Single Source of Data]

You also stay updated on how each customer segment evolves and how they impact your revenue. You can target specific marketing campaigns to different customer segments and see how each segment responds to the campaign.

3. Analyze and Update Customer Segment

Customers evolve and so should your targeting. Ensure your data is current, constantly showing the customer journey and how it evolves. Real-time data will help you make informed marketing decisions and update customer segments to ensure helpful messages are sent to the right customers. Use product analytic tools, Google Analytics, and data-driven omnichannel engagement platforms like Bunce to analyze, segment, and engage customers through the right channels.

4. Automate Marketing Campaigns

Data comprehension is tasking, you want to be sure you relieve yourself of all routine tasks like sending repeated messages and updating customer segments. Bunce can help you streamline the automating process.

5. Consistent Product Iteration

Your data can inform how to target your customers and where there’s friction in your product.

In Olamide Adurota’s words,

As a product marketer, use your product to understand the particular problems users are having. Talk to your users to know what part of the onboarding flow they have problems with. Use your data to find what part in the flow has the most drop-off. That way you can know what part of the flow to tweak or fix. Also, engage them through different channels. Create different user segments, for example, users that went from signup to the next step. Engage them and try to make them come back and complete that step.

Make constant product iterations based on the feedback you get from your data and customer interactions. This ensures you constantly deliver good customer experiences, retain customers, and build a fanbase of loyal customers.

6. Review Marketing Strategies/Campaigns

To effectively implement a data-driven marketing strategy, be quick to learn, implement, review and try again if it doesn’t work.

Say the email marketing sequence you sent to a customer segment doesn’t convert, your customer engagement tool can show you data to predict the cause and proffer a solution. It could be writing the headline differently to attract more clicks or rewriting the copy to sustain attention and make your CTAs obvious. It could also be giving enticing offers and knowing when to target a particular customer segment.

For fintechs, your product analytics can reveal what you need to work on. When it concerns discovering a friction in your campaign or customer journey, Bolaji Anifowose, Head of Partner Marketing at Distrobird said,

If free trial users drop off, check the quality of your signups, if the quality of signups are a fit for your product, you want to do more customer interviews and surveys. But not just surveys, speak to them, select people to talk to, and check your CRM, product analytics tool or any tool you use. Your marketing messages should be clear even before it gets to the signup stage. It has to be clear to ensure you’re attracting the right type of people.

Reviewing your marketing messages and strategies increases your chances of converting customers.

Bunce, our data-driven customer engagement tool can help you keep track of customer data in real time. You can track relevant customer and business metrics like CLV, churn, retention and revenue growth, and use these to make data-driven decisions, set up effective marketing campaigns targeted at specific customer segments.

To get started, sign up here.