The demand for immediate value is high and there’s low tolerance for figuring out a complex product, especially for Fintechs with limited time to prove product value.

If customers don’t get immediate value, you risk having churned or inactive customers who don’t get past the onboarding process. This is why it is important to deliver a smooth customer experience that can take the customer from the signup to their Aha moment, the moment when the customer discovers the value of the product.

As a product marketer, one of the ways to know if your product has achieved this is to check your customer engagement level. And that’s what I address in this piece—the metrics to look out for when measuring your customer engagement to discover what works and doesn’t. You’ll also learn how omnichannel customer engagement can improve your customer retention and conversion rates, and how Bunce does this.

For Interesting stories, tips and insights on customer engagement, subscribe to our newsletter.

Measuring Your Customer Engagement Effort

Different things connote customer engagement for different businesses, from customers engaging a brand posts on social media to increased time spent browsing a product landing page. For SaaS brands, especially Fintechs, it means a different thing and it revolves around these metrics:

1. Activation rate

Activation rate is the number of customers who complete their user journey from signup to onboarding and active product usage. However, it’s common to have users who sign up and don’t use the product. A couple of reasons can be responsible for this. For example, product complexity or the product not meeting customers’ expectations. Sometimes, customers just need the extra nudge to get them started and an effective communication flow can help you achieve this.

Setting up omnichannel customer engagement that takes into consideration the user journey from when they sign-up, up to their evolving life cycle within the product is an important strategy to improve activation and retention rates.

For example, for a savings platform, set up in-app guides and notifications to help users move from signup to exploring different savings plans, and to save monthly.

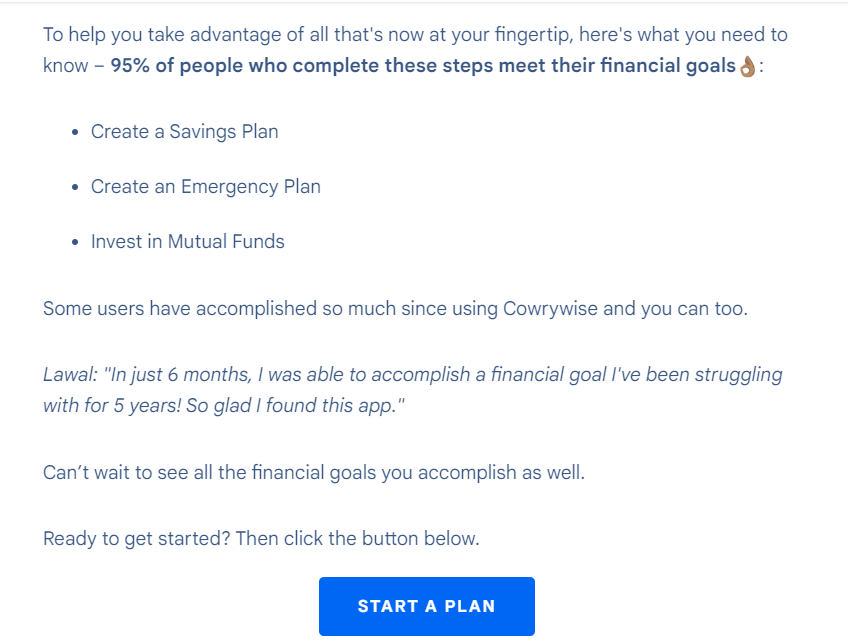

Cowrywise is one brand that has a strong customer engagement strategy that nudges customers to take action per time, just as seen in the email sent upon signing up on the platform.

One thing to note, it’s not just about sending messages across channels but sending the right messages that can stir action. As shown, Cowrywise shares:

- Its different savings options

- A customer testimonial, and

- A call to action to get started.

In the app, there are also easy prompts to get users started.

Omnichannel customer engagement platforms like Bunce can help build complex customer journeys that leverage the communication channels your audiences use most to increase your activation and conversion rate.

2. Product Usage

Tracking product usage helps you to see how engaged your users are, and the features that engage them the most. Track usage like daily active users (DAU), monthly active users (MAU), etc., to discover returning users and how they use the product. This helps you to create segments of different types of users and gain insight into the segment of users who are churning or show a sign of churn. Also, look out for pages within the product your users spend more time on and optimize if necessary.

The insights you gain from tracking product usage will give valuable feedback to the product, marketing, and customer success teams to make informed decisions that will bring customer satisfaction across teams and increase customer lifetime value.

Use heatmap tools to identify how customers engage with the product at each point. And if you notice friction in the flow, create in-app guides or educational resources to educate users more. Use analytics or data-driven customer engagement tools to track customer data and efficiently engage customers through the right channels.

With customer engagement tools, you can segment customers and discover customers with low product usage, and create automation flows that will engage them. Increasing product usage and customer lifetime value.

3. Churn Rate

Churn rate is the number of users that have stopped using your product. For a savings platform, a sign of churn is having users who sign up and stop saving on the platform after a while. In no time, these users will disconnect their cards and abandon the platform.

Use a data-driven customer engagement platform like Bunce or your product analytics tool to track churned and at-risk of churn users for each customer segment to know the kind of customers churning, the possible reason for churning and how to engage them to get back on the platform and resume their saving habit.

However, a proactive and effective communication flow across multiple channels can help to increase customer retention. Sending timely reminders may help to keep the product in the minds of the customers, this also shows care for the customer and their commitment to developing a healthy money habit.

For example, Cowrywise uses push notifications and other creative savings plans to remind and motivate users to keep saving. Another motivation strategy they use is awarding streaks to users based on their saving performance and accomplishment of their financial saving goal.

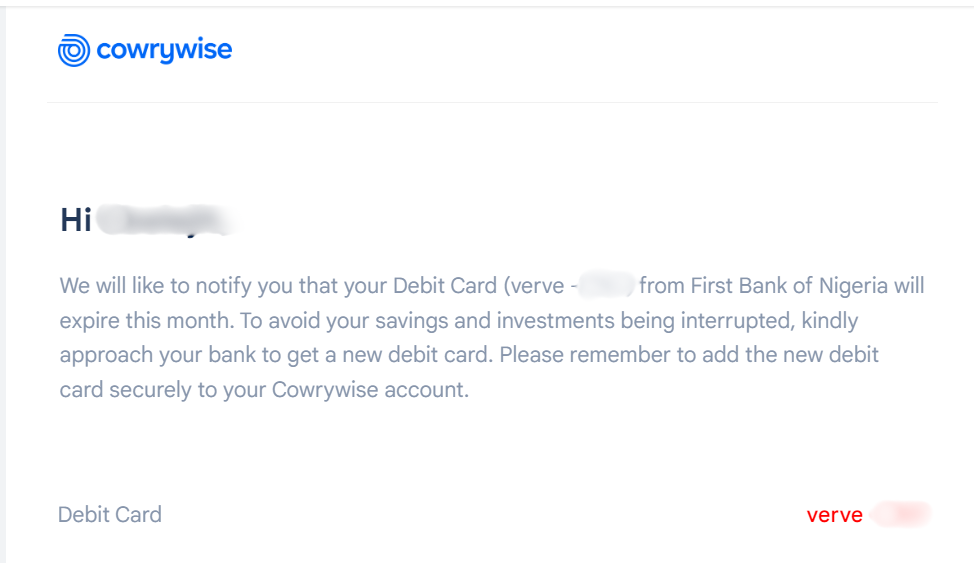

One reason that may lead to churn is failed payment, a case where a user’s card expires and the user is unable to make transactions. This can frustrate the customer. In this case, you must employ proactive payment recovery strategies to dictate and notify customers to renew their cards and update their card details on the platform. Here’s an example from Cowrywise.

An increase in churn is a concern the product team should look into to learn how to communicate relevant information to the marketing and customer success team.

4. Customer Lifetime Value

Customer lifetime value is one of the most important metrics that show customer engagement. This is calculated as the amount of money a customer is worth over their lifetime or relationship with the business. To improve customer lifetime value, the customer experience must be top-notch to keep customers constantly engaged. Besides having a great product, customer success is the function of every team in the company.

5. Customer Engagement Score

There is no one way to measure the customer engagement score. It is peculiar to every business and is the metric or particular actions that define customer engagement. For example, for investment apps, it can be the number of investments made or Asset under management (AUM) metric which is the worth of customer investments a company holds. Whatever your customer engagement metric is, you should calculate this to determine how engaged your users are.

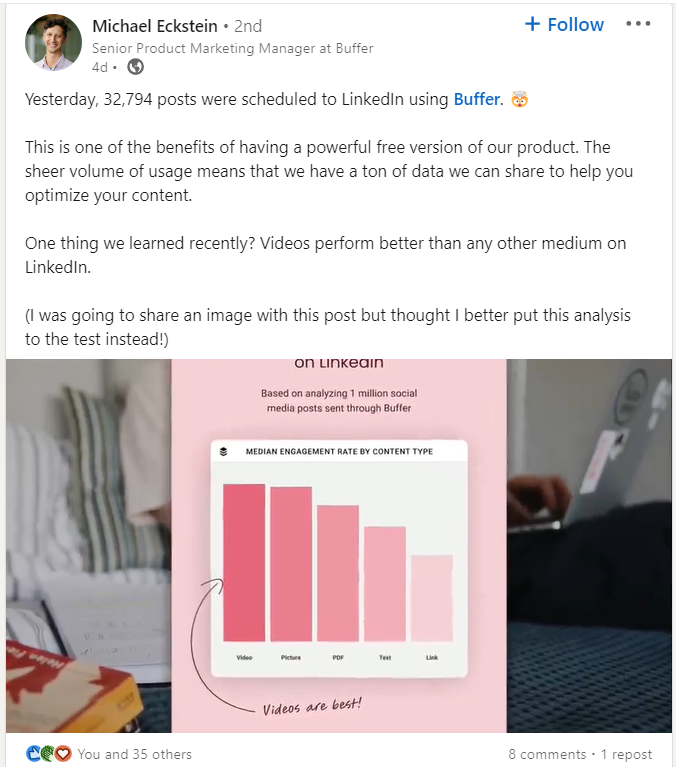

A good example of identifying customer engagement score is this post by Michael Eckstein, Senior Product Marketing Manager at Buffer, a social media toolkit for creators and teams.

The customer engagement score for Buffer is the number of posts scheduled using Buffer. 32,794 posts in a day is great feedback for the Buffer team showing customer engagement and product value, even for their free version users.

Beyond feedback for the team, the customer-centric team uses the feedback to give valuable recommendations to its users. This improves the customer experience and delivers the brand’s promise “Grow your audience on social and beyond” to its customers.

Takeaways from Buffer:

- Create a helpful product

- Make your user experience great, it’ll attract more users

- Analyze your customer data and use it to send helpful recommendations to users.

A healthy customer engagement score shows customer satisfaction. The more customers are satisfied, the more they refer your product, the more revenue increases.

Use Bunce for Omnichannel Customer Engagement

Conversion is at the heart of every business, but a greater satisfaction is knowing that an increase in conversion rate signals you’re doing something right and it’s why customers choose you.

This customer trust is strengthened by seamless and consistent communication helping customers achieve their goals. For communication to be effective, businesses need to be present in multiple channels, because the customer journey isn’t static. Customers communicate via different channels.

It’s why omnichannel customer engagement is important, helping you reach customers at the right time using the right channel, customer calls, in-app messages, emails, push notifications, WhatsApp prompts, etc. Using omnichannel customer engagement strategies, you retain 89% of your customers, as opposed to brands who don’t.

Bunce, our data-driven customer engagement platform can help you retain your customers and increase conversion rates.

Here’s how.

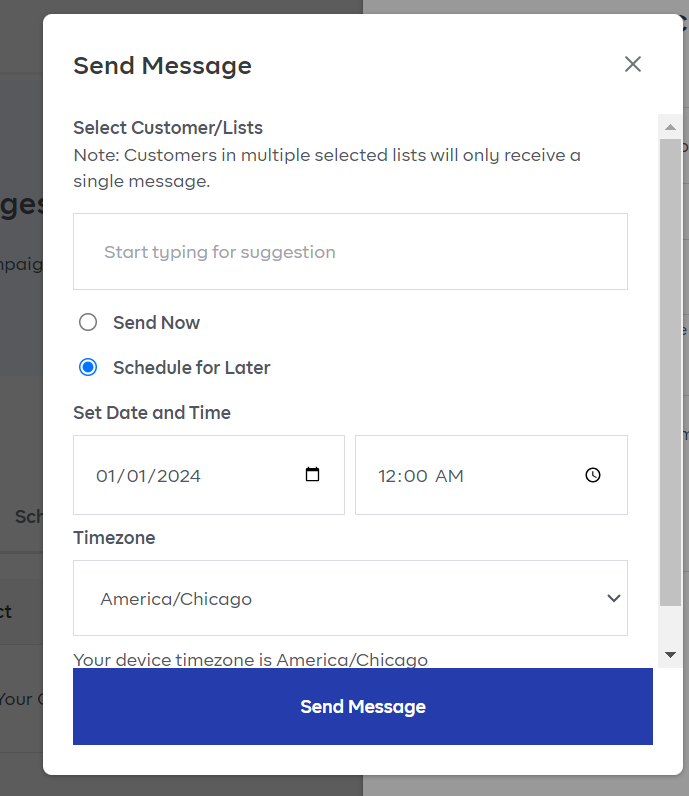

With our data-driven customer engagement platform, you can get insights into your customer data. Insights like which customer segments bring in more revenue, active and inactive users. Using different channels, you can then send relevant messages to customers and build automation flows scheduling messages across multiple channels based on the user journey.

This increases your customer retention and conversion rate and helps you build better relationships with your customers.

All you need to do to get started after signing up is to connect your customer data sources like your payment providers or Excel sheet and within minutes you’ll be able to set up and send messaging campaigns to your different customer segments.

Want to find out how Bunce can help improve your customer engagement and conversion rates, sign up and enjoy a 7-day free trial.