In every business, happy hour is when the customer makes a purchase. With innovative payment companies, businesses can now receive payments from customers all over the world via different payment methods. But happy hour doesn’t always reach its peak. Many of these payments fall through.

According to research by Lexis Nexis, 60% of organizations reported losing customers due to failed payments. Furthermore, these failed payments cost the global economy $118.5 billion in 2020.

As one involved in running a business, you’re no stranger to this problem. You’ve likely lost customers due to failed payments.

It makes the question, “How do you reduce failed online payments for your business?” a very important one.

This article will answer the above question. I’ll show you how payment automation solves this problem and influences business growth.

Sounds good?

Let’s get started.

What is Payment Automation?

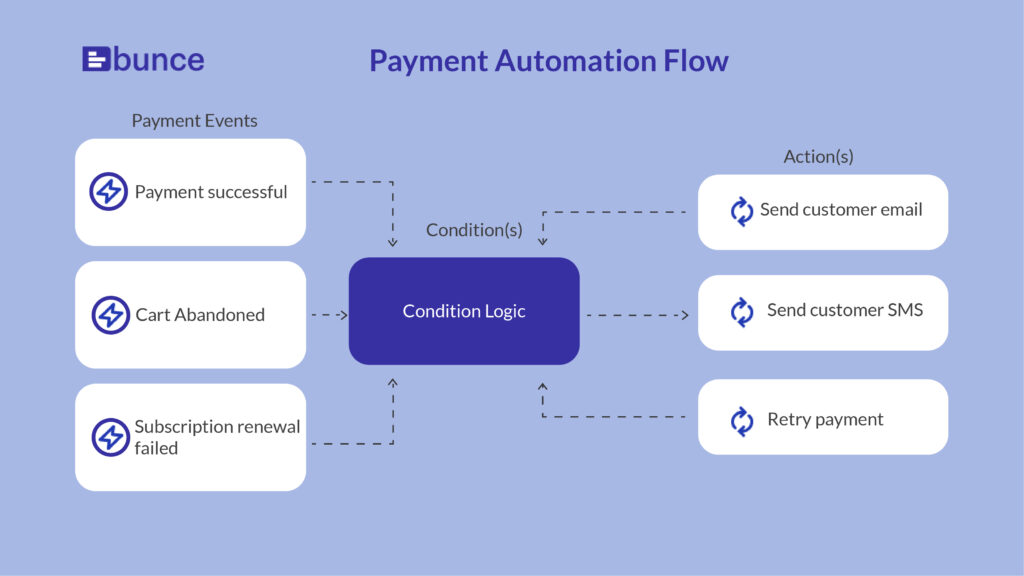

Payment automation is an end-to-end process that allows you to easily send out and receive payments for goods/services rendered by vendors or to customers. It automates payment workflows like notifying customers of transaction status, sending invoices, customizing and sending receipts, notifying customers of upcoming payments, and many more.

As a business owner at whatever scale, you must have encountered these questions in a bid to ensure you get paid:

- What payment methods (virtual cards, credit/debit cards, bank transfers, etc.) do I want to make available to my customers?

- Where are my customers buying from?

- What payment methods/services are available in those areas and how do I integrate them?

- How do I make the process easier for customers so I can always receive my payments, whether they are one-time payment or recurring bills?

- How do I reconcile failed payments?

- And how do I avoid or reduce failed payments?

The answer to the questions above lies in payment automation. It allows business owners/employees time for other productive tasks rather than chasing payments. And it also provides a great experience for customers.

How does the automation process work? See below.

2 Ways Businesses Can Automate Their Payment Collection Process

Businesses have different needs when it comes to payment automation. A business may want to incorporate a payment processor that helps them pay money to vendors and employees while some want to automate the collection process which helps them receive money from customers. If you’re looking to automate your payment collection process, here are 2 ways to do so.

1. Payment Service Provider Integration

When you hear Payment Service Providers (PSPs), think Paystack, Flutterwave, or Paypal. These PSPs are third-party services that help merchants accept payments easily using different payment methods (credit/debit cards, bank transfers, e-wallets) from different countries.

Business owners need to determine the most reliable PSP to use to receive payments, and this decision is made based on factors like speed, transaction costs and country.

Each country has its unique regulatory rules and so some PSPs may have restrictions in certain countries. Or for some other reason, processing payments using a particular PSP may not be fluid at the moment of transaction so having other options is a great idea.

2. Payment Orchestration

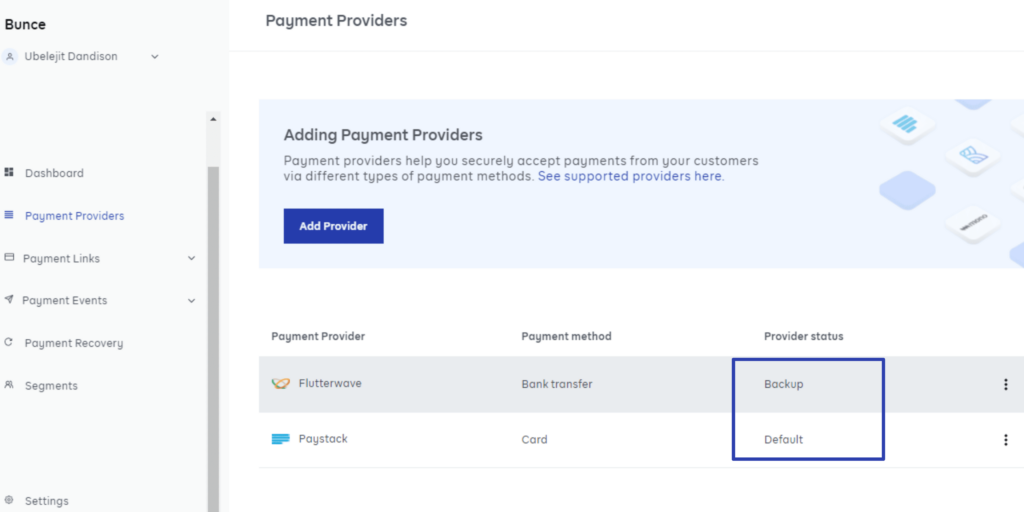

Simply put, payment orchestration gives businesses the option of using multiple payment providers in one system.

Say you own a clothing business and use Flutterwave to accept payments in Ghana. Now for some reason, Flutterwave is down and you have trouble accepting payments. What would likely happen? The customer gets frustrated after several attempts to make payment and drops off. Another case of failed online payment.

But payment orchestration helps solve this. It always ensures your customers have alternative modes of payment so if one fails, there’s another option. As you can imagine, this would reduce the number of customer drop-offs. Here’s how it works.

- You set your priority payment provider,

- Set one or two backup payment providers

- Set up your payment page and share the link to your customer

So whenever anything goes wrong with your preferred payment provider, the system re-routes the payment through the backup PSP to ensure payment receival.

Easily integrate multiple payment providers with Bunce and provide your customers with multiple payment options. Want to see how it works? Watch Demo

How Payment Automation via Payment Orchestration Influences Business Growth

Research by Baynard Institute shows that 9% of customers drop off because there aren’t enough payment methods and 4% drop off due to declined cards. This shows that payment automation is important, and offering multiple options is necessary. Implementing the two helps businesses capture revenue and impact growth positively through the following ways.

1. Better Customer Experience

Great customer experience is essential to the growth of any business. Even a company with the best product will face many problems if its customer experience is poor.

According to research, 86% of customers will pay more for a better customer experience. This is why you should ensure every touch point in your customer’s buying process is optimized and seamless. Pay special attention to the checkout process and ensure it is smooth as this is often the point where you gain or lose money.

With payment orchestration, you can improve customer experience at the point of payment initiation. The availability of multiple payment options helps the customer feel unrestricted, increasing the chances that they’ll pay thus contributing to business growth.

2. Reliability

Customer trust is an expensive commodity that every business must earn. For instance, earning customers’ trust is why Cash on Delivery is a popular option in many e-commerce companies. Buyers are often skeptical about making online payments, and companies respond by offering them an option that works to allay their fears.

Payment automation via orchestration is a good way to gain buyer’s trust and grow the business as it takes measures to avoid failed online payments. When customers can trust your service, you’ll be top of their minds when they want to buy or refer a friend. Generally, trust is a barrier with cloud services but a smooth payment process makes it better.

3. Reduces Cost

Profit is the lifeblood of any business. The following possibilities show how payment orchestration helps your business minimize cost and maximize opportunities to increase revenue.

- It saves time and eliminates the cost of having engineers integrate and maintain multiple payment providers separately. Having all your payment providers integrated on one platform gives you a broad overview and helps you manage them better.

- Payment orchestration serves as a proactive measure to churn- you don’t need to wait till you lose customers (profit) before deciding on an alternative payment provider to integrate.

- Different payment providers have varying transaction costs. Depending on your transaction amount and the charges applied, you can automatically switch to the more favourable PSP, with an orchestration platform.

After Automating and Orchestrating Payments, What Next?

Payment automation is cool. Orchestration is even cooler.

But what’s next? What happens if, despite all these efforts, customer payments still fail? How do you recover the failed payment, engage customers and ensure they return?

Enter point payment recovery

Curious about this concept? Find out all you need to know about it in our follow-up piece on recovering failed online payments.

Easily integrate multiple payment providers with Bunce and provide your customers with multiple payment options. Want to see how it works? Watch Demo and signup to try Bunce.