Why do you think highly-rated restaurants have various dishes on their menu?

For one, they want to flaunt their variety. But more importantly, they know their customers are different and they want to meet each customer’s specific needs.

That is the goal of customer segmentation; to serve customers with offers targeted to meet their needs at any given time.

As you know, customers regularly experience shifts in interest. A great way to stay up to date with these changes is by studying your customers’ purchasing behaviour and constantly updating your customer segments for effective targeting.

To do this efficiently, payment data becomes important for customer segmentation. In this article, I’ll show you the benefits of using payment data for dynamic customer segmentation.

Benefits of Dynamic Customer Segmentation

Segmentation is not a once and for all affair. A customer could experience change that causes him to move through different segments in one month and that’s why dynamic segmentation is important. Before I discuss its benefits, let’s delve deeper into dynamic segmentation.

What is Dynamic Customer Segmentation?

Dynamic segmentation is the practice of grouping customers or target audiences based on real-time and continuously updated data.

Unlike traditional static segmentation which categorizes customers into fixed segments based on predefined criteria, dynamic segmentation adapts and evolves based on the changing behaviour, preferences, and characteristics of customers.

Dynamic segmentation takes advantage of real-time data sources, such as customer interactions, purchase history, payment events, and other relevant data points. This data is continuously analyzed and used to create segments that reflect the current state of the customer base.

Here are some benefits of dynamic segmentation:

1. Target customers with precision

By constantly monitoring and analyzing customer data, businesses can identify and target specific customer segments that are most likely to respond positively to their marketing efforts.

In the words of Laura Erdem, senior account executive at Dream Data,

(Re)focus your targeting on your best converting segments. One of the first exercises you have to do is ‘double check your targeting and make sure that you’re putting dollars on your best-performing audiences’. By doing so, you eliminate wasted valuable dollars on audiences that won’t convert.

Dynamic segmentation helps you to target customers with such precision without leaving money on the table.

2. Deliver personalized experiences

With dynamic segmentation, businesses can create personalized marketing campaigns, customized product recommendations, and tailored experiences based on the unique characteristics and behaviours of each segment. The state of personalization report by Twilio shows that 60% of customers are most likely to be repeat buyers after a personalized shopping experience.

3. Optimize marketing strategies

By gaining insights from real-time data, businesses can fine-tune their marketing strategies and messaging to ensure maximum effectiveness and return on investment.

4. Enhance customer engagement and loyalty

Personalized and targeted marketing messages build stronger connections with customers, increasing engagement and fostering customer loyalty.

5. Adapt to changing customer behaviour

Dynamic segmentation allows businesses to adapt quickly to shifts in customer preferences, market trends, and other external factors, ensuring their marketing efforts remain relevant and effective.

These ultimately lead to a higher conversion rate and better return on investment.

Why Using Payment Data is Valuable for Customer Segmentation

Payment data allows businesses to glean insights into customer spending patterns, and observe customer engagement, and preferences which allow for effective segmentation.

1. Understand payment patterns

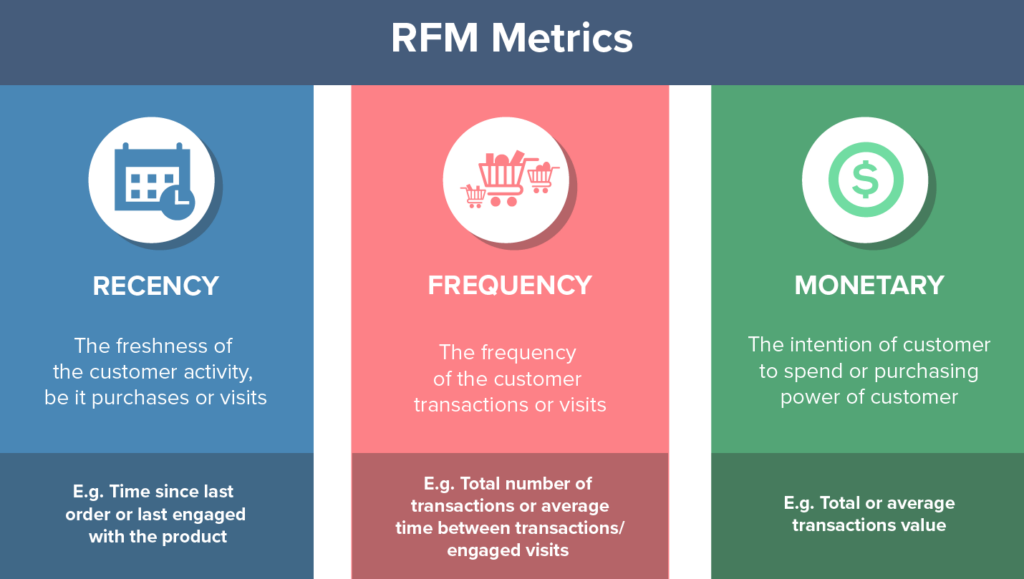

The Frequency, Recency, and Monetary (FRM) framework is popularly recommended for using payment data for customer segmentation.

[Source]

With payment data, you can discover and segment customers based on payment frequency, recency, and monetary value. Monetary value informs you of customer purchasing power and helps you identify high-paying and low-paying customers.

Payment frequency helps you to discover active and inactive customers, fast-paying customers, and customers who take some time before paying.

Monitoring and segmenting customers based on payment recency can help you to discover the most active customers, recent high-paying customers, and potential customers for upsell and cross-sell opportunities.

You can also discover new customers. With this insight, the marketing team can group and nurture new customers with the goal of targeting specific messaging to them.

2. Discover customer payment status

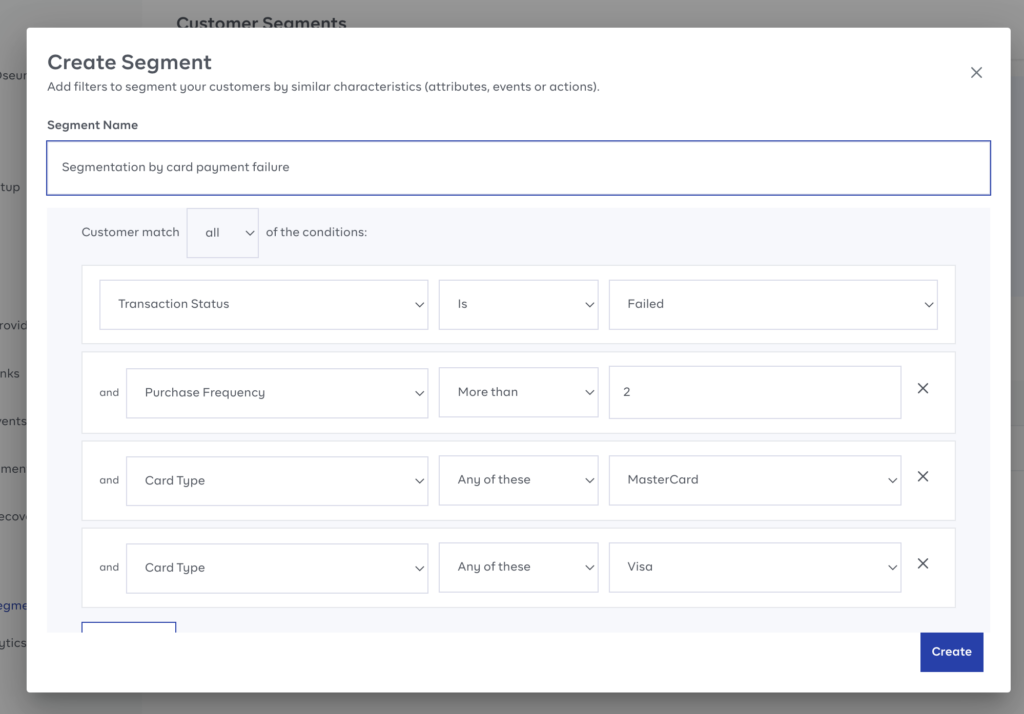

In an automated payment system, payment data helps you to track customer payment status and in the case where a payment fails, discover the reason for the payment failure; card expiration, wrong card information, or network error, and segment users for specific messaging. This information helps you to quickly recover failed payments by automatically sending other payment channel options for payment. It also helps to identify fraud.

[Bunce Customer Segmentation by card payment failure]

3. Discover preferred payment methods

Customers have different preferred payment methods. Payment data allows you to monitor and segment customers based on payment methods. For instance, you could segment users that pay with a certain card type {Mastercard, Visa} or through bank transfers.

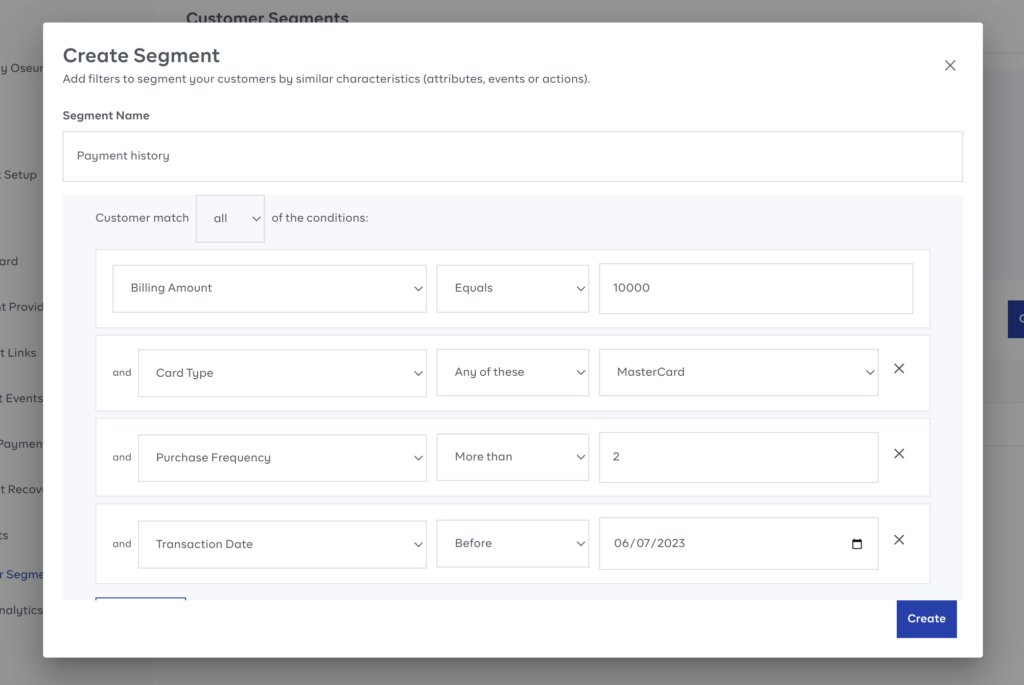

4. Track transaction history

What better way to track transaction history than through payment data? There’s a lot you can do with a customer’s transaction history.

[Bunce Customer Segmentation by Transaction History]

- Tracking customer transaction history can help you to discover customers who churned or are likely to churn. With this insight, you can determine how to engage them. For customers who are likely to churn, you can offer enticing discounts to re-engage them.

Take for instance, for e-commerce businesses, a customer who loves to buy housewares can be targeted with a discount offer on selected housewares.

- Besides trying to re-engage, you can know the customer lifetime value of churned customers. Put simply, the total worth of the customer while they stayed with your business, and make strategic efforts to win back high-value customers.

If you discover a high-paying customer churned or is likely to churn, you would want to reach out to find out why. One of the ways you can do this is by sending a survey form.

- For existing customers, studying transaction history can reveal cross-sell and upsell opportunities. Questions to ask when studying transaction history would be:

- What product/service has this customer been paying for?

- What complementary service or product would they appreciate?

- How can I make the offer enticing so they can easily buy?

These questions help you to predict customer needs and satisfy them.

5. Track conversion rate

Payment data can help you to know the conversion rate of each segment you create which informs the effectiveness of your marketing/sales strategy. For subscription businesses, payment data can help you discover the following:

- Free trial conversion rate to know whether or not there is a problem with customer onboarding.

- Product preference to reveal the features users prefer

- MRR on each subscription plan to know how much the business makes on each plan monthly. This is different from overall monthly recurring revenue.

- Most subscribed plan to reveal the purchasing power of users or their most valuable plan. It will also allow marketing teams to focus on delivering at-par customer experience to their best segments while nurturing the segments that are still cold.

Laura Erdem said it best.

(Re)focus your targeting on your best converting segments. One of the first exercises you have to do is ‘double check your targeting and make sure that you’re putting dollars on your best-performing audiences. By doing so, you eliminate wasted valuable dollars on audiences that won’t convert.

Payment Data Customer Segmentation with Bunce

Bunce provides real-time data for effective and dynamic customer segmentation. Here are two use cases on Bunce.

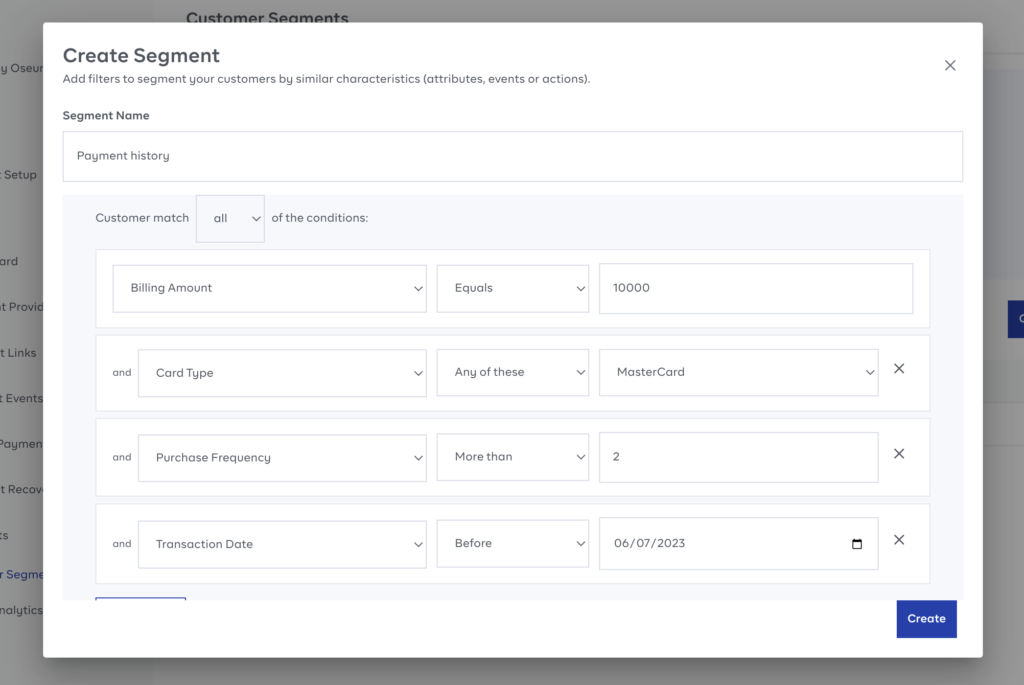

1. Personalized marketing campaigns

By analyzing payment data in real time, businesses can dynamically segment their customer on Bunce and create personalized marketing and campaigns. They can tailor promotional offers, discounts, or product recommendations based on customers’ purchasing behaviour, payment preferences, or transaction history. This targeted approach enhances customer engagement, increases conversion rates, and fosters customer loyalty.

[Bunce Customer Segmentation by Transaction History]

2. Prediction and customer retention

By analyzing factors like payment frequency, payment delays, or declined payments, businesses can segment their customer base and detect early warning signs of potential churn. This enables targeted retention efforts, such as personalized offers or proactive customer support, to prevent customer attrition and improve overall retention rates.

Everyone loves to be treated specially and your customers are no different. Use the power of data-driven customer segmentation to reach your customer base and make efforts to satisfy their specific needs.

Make the smarter choice to meet your customers where they are by trying out Bunce, the payment automation and customer value management platform for businesses. Sign-up now.